10 Gram Gold Price In USA Today – Check Rates

Are you curious about the current gold prices in the USA? If you’re looking for accurate information on the 10 gram gold price in the USA today, you’ve come to the right place. In this article, we will provide you with the latest rates and essential details you need to know.

As of today, the gold price in the USA for 10 grams of 24K gold is USD 654.74. However, it’s crucial to note that gold prices can vary based on factors such as location, market conditions, and additional charges.

Tracking gold rates is essential for investors, buyers, and enthusiasts alike. Whether you’re planning to invest in gold or simply interested in staying informed about market trends, knowing the current gold price in the USA today is crucial. Stay tuned as we dive deeper into understanding gold prices, different forms of gold, factors affecting prices, and much more.

Understanding Gold Prices In The USA

Gold prices in the USA are influenced by several factors that can cause fluctuations on a daily basis. It is essential to understand these factors to make informed decisions when it comes to buying or selling gold.

One of the primary factors affecting gold prices is global demand and supply. The demand for gold, both for industrial and investment purposes, plays a significant role in determining its price. Economic conditions, such as interest rates, unemployment rates, and GDP growth, also impact gold prices. In times of economic uncertainty, investors tend to turn to gold as a safe-haven asset, driving up its price.

Inflation is another crucial factor that affects gold prices. When inflation is high, the purchasing power of fiat currencies decreases, leading investors to seek alternative stores of value like gold. As a result, the demand for gold increases, causing its price to rise.

Currency fluctuations can also impact gold prices in the USA. The value of the US Dollar (USD) relative to other currencies can influence the demand for gold. When the USD weakens, gold becomes relatively cheaper for international buyers, increasing its demand and price.

Geopolitical events and uncertainties in the global landscape can have a significant impact on gold prices as well. Political tensions, wars, and conflicts can create a sense of instability, driving investors towards gold as a safe-haven investment.

Understanding the factors mentioned above can help individuals and investors track and analyze gold prices in the USA effectively.

These factors affecting gold prices are not exhaustive, and other market dynamics may also come into play. It is crucial to stay informed about the latest trends and factors influencing the gold market to make informed decisions.

Gold Rates In Different Forms

The price of gold in the USA varies depending on its purity and form. As mentioned earlier, the price for 10 grams of 24K gold is USD 654.74. However, it’s essential to note that gold prices can differ for other forms, such as per ounce or per tola.

Price Of 22K Gold

For those interested in 22K gold, the price is USD 600.18 per 10 grams. This form of gold, which contains 22 parts pure gold and 2 parts other metals, is commonly used in jewelry making.

Investors and buyers should consider the different forms of gold and their corresponding rates when making purchase decisions. The choice between 24K and 22K gold often depends on personal preference, budget, and intended use.

Now, let’s take a closer look at the significance of currency rates on gold prices in the USA.

The Impact Of Currency Rates On Gold Prices

The value of the US Dollar (USD) plays a significant role in determining gold prices in the USA. As the USD strengthens, the price of gold tends to decrease, and vice versa. This correlation is due to the inverse relationship between the value of the USD and the demand for gold as a safe-haven asset.

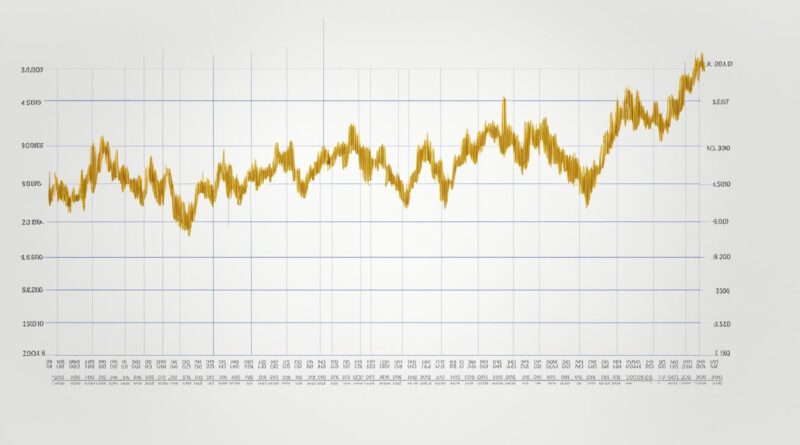

Historical Gold Price Trends In The USA

Historical data reveals fascinating insights into the fluctuating nature of gold prices in the USA. Over the years, gold prices have experienced significant volatility due to various factors such as economic crises, inflationary periods, and geopolitical tensions. Examining historical gold price trends allows investors and buyers to gain valuable insights. By analyzing these trends, they can make informed decisions and navigate the dynamic gold market effectively.

The gold market has witnessed ups and downs throughout history, responding to economic and political events. In times of economic uncertainty, such as during recessions or financial crises, gold prices tend to rise as investors seek a safe-haven asset. Conversely, during periods of stability and economic growth, gold prices may experience downward pressure.

Geopolitical tensions and global events also impact gold prices. Conflicts, political instability, and changes in international relations can create volatility in the market. Investors closely monitor these events, identifying opportunities to capitalize on price fluctuations and protect their wealth.

By delving into historical gold price trends and conducting thorough gold price analysis, investors can gain valuable insights into market patterns, seasonality, and long-term price projections. Understanding the historical context helps in formulating effective investment strategies and risk management plans.

Gold’s historical price trends are a testament to its enduring value and the role it plays in investment portfolios. Considering these trends alongside current market conditions can help investors make informed decisions and capitalize on potential opportunities in the gold market.

Considerations For Investing In Gold

Investing in gold can serve as a strategic move to diversify your portfolio and protect against economic uncertainty. However, before making any investment decisions related to gold, it’s crucial to consider several factors.

Market Conditions

Gold market analysis is essential to understand the current state of the market. Factors such as supply and demand, economic indicators, and geopolitical events can influence gold prices. Stay informed about market trends by tracking live gold prices and analyzing market reports.

Risk Appetite

Every investor has a different risk tolerance. Evaluate your risk appetite and determine how much of your portfolio you are comfortable allocating to gold. Gold is considered a relatively stable investment, but like any investment, it carries risks.

Investment Goals

Clearly define your investment goals before investing in gold. Are you seeking long-term wealth preservation, protection against inflation, or short-term profit opportunities? Your goals will shape your investment strategy and help you make informed decisions.

Expert Analysis

Seek advice from gold market analysts or financial advisors who specialize in precious metals. Their expertise and insights can provide valuable guidance in navigating the gold market. Consider various opinions and conduct thorough research before making investment decisions.

Remember, investing in gold requires careful consideration and analysis. By staying informed, understanding market conditions, assessing your risk appetite, defining your investment goals, and seeking expert advice, you can make strategic investment decisions related to gold.

Where To Track Live Gold Prices In The USA

For individuals interested in tracking live gold prices in the USA, several websites offer up-to-date information on gold rates. These platforms provide users with the ability to stay informed about the latest market trends and fluctuations in gold prices. By monitoring live gold prices, users can make informed decisions regarding their investments and financial strategies.

Here are some popular options for tracking live gold prices:

- LivePriceofGold.com: LivePriceofGold.com is a reliable website that offers real-time updates on gold prices in the USA. The platform provides users with live gold rates in different forms and currencies, making it a valuable resource for investors and buyers.

- Hamariweb: Hamariweb is another trusted website that allows users to track gold prices in the USA. The platform provides comprehensive information on gold rates and offers users the ability to compare prices between different forms of gold.

- GoldPriceUSA.com: GoldPriceUSA.com is a popular website known for its accurate gold price tracking. Users can access live gold prices, historical data, and additional resources to make informed decisions regarding gold investments.

By utilizing these gold price tracking websites, individuals can keep a close eye on live gold prices, ensuring they have the most up-to-date information at their fingertips. Whether you are an investor, buyer, or simply interested in following gold price trends, these platforms provide valuable insights for tracking gold prices in the USA.

Conclusion

In conclusion, the gold price in the USA today stands at USD 654.74 for 10 grams of 24K gold. However, it’s crucial to understand that gold prices are influenced by various factors, including economic conditions, currency rates, and global events. As an investor or buyer, it is imperative to stay informed and use reliable sources to track live gold prices before making any transactions.

Doing thorough research and consulting with experts are essential steps before making any investment decisions related to gold. By considering market conditions, risk appetite, and investment goals, individuals can make informed choices in diversifying their portfolios and hedging against economic uncertainty.

To track live gold prices in the USA, there are several reputable websites available like LivePriceofGold.com, Hamariweb, and GoldPriceUSA.com. These platforms provide up-to-date information on gold rates in different forms and currencies, enabling users to stay updated with the latest market trends.

Overall, understanding the factors that influence gold prices and staying informed about live rates are crucial for investors and buyers. By following these practices, individuals can make informed decisions and navigate the gold market effectively.

FAQ

What Is The Current Gold Price For 10 Grams In The USA?

The gold price in the USA today is USD 654.74 for 10 grams of 24K gold.

What Factors Can Cause Fluctuations In Gold Prices?

Gold prices in the USA are influenced by factors such as global demand and supply, economic conditions, inflation, currency fluctuations, and geopolitical events.

How Do Gold Rates Vary Based On The Purity And Form Of Gold?

The price mentioned earlier is for 10 grams of 24K gold. The price of 22K gold per 10 grams is USD 600.18. Gold prices can also vary for other forms such as per ounce and per tola.

How Does The Value Of The US Dollar (USD) Impact Gold Prices?

The value of the US Dollar (USD) plays a significant role in determining gold prices in the USA. As the USD strengthens, the price of gold tends to decrease, and vice versa.

What Historical Data Reveals About Gold Prices In The USA?

Historical data shows that gold prices in the USA have experienced significant fluctuations over the years due to factors such as economic crises, inflationary periods, and geopolitical tensions.

Is Investing In Gold A Strategic Move?

Investing in gold can be a strategic move for diversifying a portfolio and hedging against economic uncertainty. However, it’s important to consider factors such as market conditions, risk appetite, investment goals, and expert analysis before making any investment decisions related to gold.

Where Can I Track Live Gold Prices In The USA?

Several websites provide up-to-date information on gold prices in the USA, including LivePriceofGold.com, Hamariweb, and GoldPriceUSA.com. These websites offer live gold rates in different forms and currencies, allowing users to track the latest market trends.

What Should I Consider Before Making Any Gold-Related Transactions?

Before making any gold-related transactions, it’s important to consider various factors that can influence gold prices, such as economic conditions, currency rates, and global events. Investors and buyers should stay informed and use reliable sources to track live gold prices before making any transactions. Thorough research and expert consultation are advised when making investment decisions.